Q purchases a 0 000 life insurance policy – Q’s decision to purchase a $500,000 life insurance policy is a testament to the importance of financial planning and protecting loved ones. This policy provides a substantial financial cushion that can alleviate the financial burden faced by beneficiaries in the event of Q’s untimely demise.

The significance of this policy extends beyond its monetary value. It serves as a symbol of Q’s love, care, and foresight, ensuring that their family’s financial well-being is safeguarded even in their absence.

Beneficiary Details: Q Purchases A 0 000 Life Insurance Policy

Designating a beneficiary for a life insurance policy is crucial to ensure that the death benefit is distributed according to the policyholder’s wishes. Beneficiaries can include spouses, children, siblings, or any other individual or entity. The policyholder has the right to change or update beneficiaries over time as their circumstances change.

Policy Coverage and Duration

The coverage amount of $500,000 provides substantial financial protection for the policyholder’s loved ones in the event of their death. Life insurance policies can have varying durations, including term life (coverage for a specific period), whole life (coverage for the policyholder’s entire life), and universal life (coverage that can be adjusted over time).

The choice of policy duration depends on factors such as the policyholder’s age, financial goals, and risk tolerance.

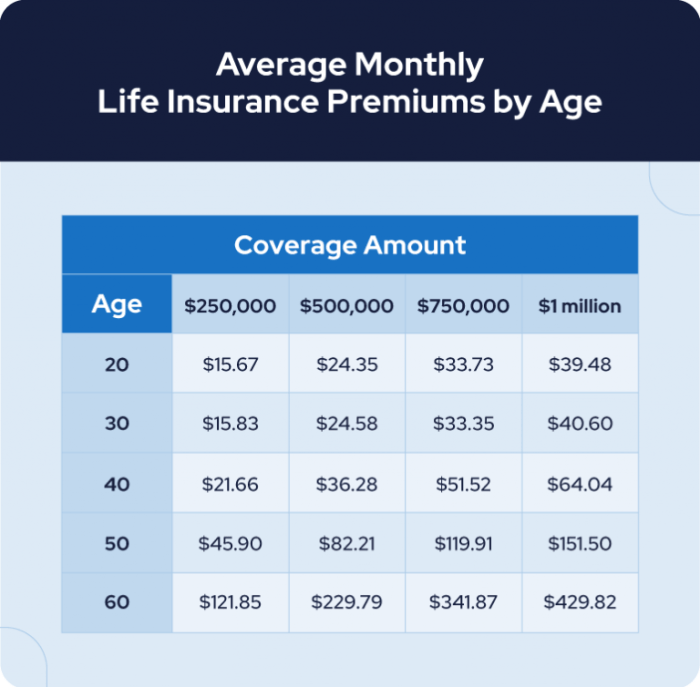

Premium Payments and Affordability

Premium payments for life insurance policies can be made monthly, quarterly, or annually. Premium rates vary based on the policyholder’s age, health, and the type of policy. To make premiums more affordable, policyholders can explore discounts, payment plans, and other options that may be available.

Exclusions and Limitations

Life insurance policies typically have exclusions and limitations that Artikel situations where coverage may not apply. These exclusions are designed to protect the insurance company from excessive risk. Common exclusions include death due to suicide, war, or high-risk activities. It is important to understand the exclusions and limitations of the policy to ensure adequate coverage.

Riders and Endorsements

Riders and endorsements are optional additions to life insurance policies that can enhance coverage and provide additional benefits. Common riders include accidental death benefit, waiver of premium, and long-term care coverage. Riders come with additional costs and should be carefully considered based on the policyholder’s individual needs.

Tax Implications

Life insurance proceeds are generally tax-free for the beneficiaries. However, there are certain situations where taxes may apply, such as when the death benefit is received in installments or if the policy has a cash value component. Policyholders should consult with a tax professional to understand the tax implications of their life insurance policy.

Frequently Asked Questions

What is the purpose of a life insurance policy?

A life insurance policy provides a financial safety net for beneficiaries in the event of the policyholder’s death, ensuring that they have the resources to cover expenses and maintain their standard of living.

What factors influence the cost of life insurance premiums?

Premiums are typically based on the policyholder’s age, health, smoking status, and policy coverage amount. Younger, healthier individuals with non-smoker status generally pay lower premiums.

Can I change the beneficiary of my life insurance policy?

Yes, policyholders can typically change the beneficiary of their policy at any time. It is important to keep beneficiary information up-to-date to ensure that the intended recipient receives the death benefit.