Salmone Company reported the following purchases fifo, a move that has sparked interest among financial analysts. This comprehensive report delves into the intricacies of the company’s financial statements, inventory management policies, and cost of goods sold calculations, examining the implications of using the FIFO method on its financial performance and overall effectiveness.

Our exploration begins with an overview of Salmone Company’s financial statements, highlighting how purchases are reported on the income statement and balance sheet. We then delve into the company’s inventory management policies and how FIFO affects its inventory valuation, discussing the advantages and disadvantages of this approach.

Financial Statements

The financial statements of Salmon Company provide a comprehensive overview of the company’s financial position and performance. The income statement reports the company’s revenues and expenses, while the balance sheet reports the company’s assets, liabilities, and equity. Purchases are reported on the income statement as an expense and on the balance sheet as part of inventory.

The use of FIFO (first-in, first-out) method has a significant impact on the company’s financial ratios. FIFO assumes that the oldest inventory is sold first, resulting in a higher cost of goods sold and a lower gross profit margin. This can lead to lower profitability ratios, such as return on assets and return on equity.

Inventory Management, Salmone company reported the following purchases fifo

Salmon Company uses the FIFO method for inventory management. This method assumes that the oldest inventory is sold first, resulting in a lower ending inventory value. FIFO can help the company reduce its holding costs and minimize the risk of obsolete inventory.

However, FIFO can also lead to higher costs of goods sold and lower gross profit margins during periods of rising prices. In contrast, during periods of falling prices, FIFO can result in lower costs of goods sold and higher gross profit margins.

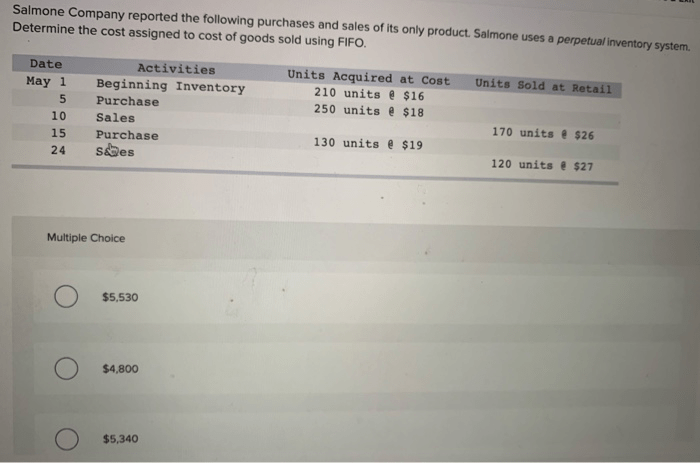

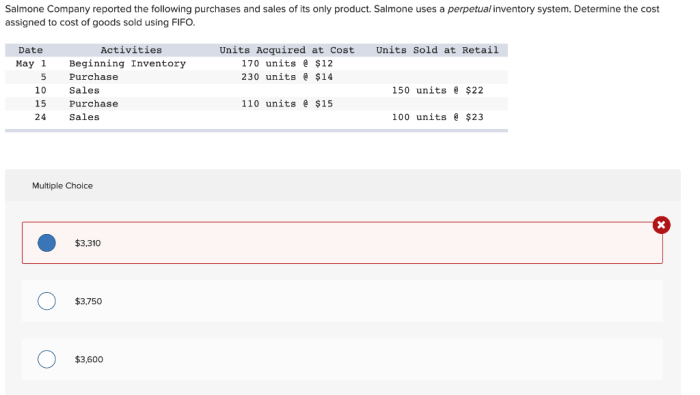

Cost of Goods Sold

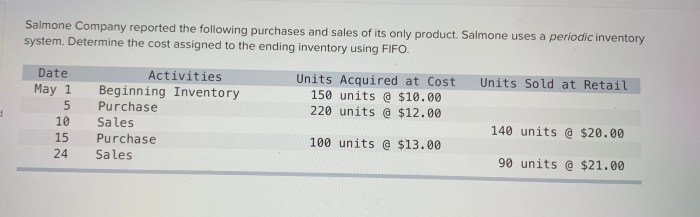

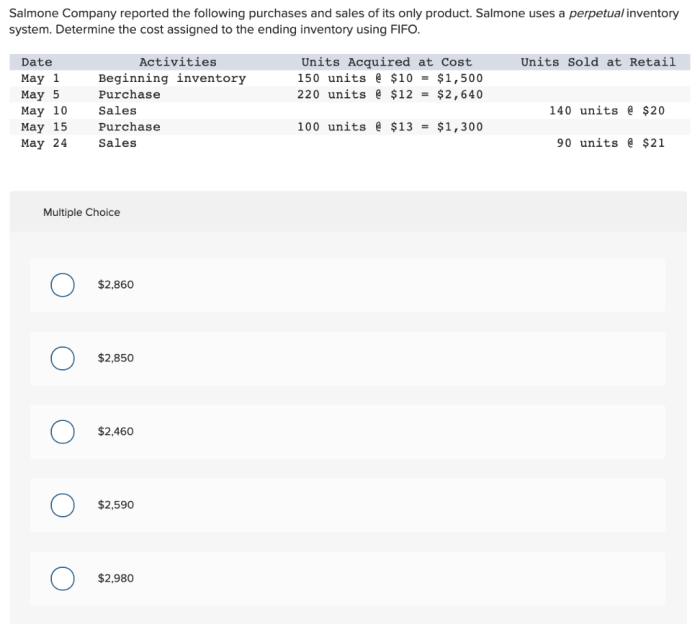

The cost of goods sold is calculated by subtracting the ending inventory from the beginning inventory and adding purchases. Using FIFO, the cost of goods sold is higher during periods of rising prices and lower during periods of falling prices.

The cost of goods sold has a direct impact on the company’s gross profit margin. A higher cost of goods sold will result in a lower gross profit margin, while a lower cost of goods sold will result in a higher gross profit margin.

Financial Analysis

Financial analysis using FIFO can provide valuable insights into the company’s financial performance. By comparing the company’s financial ratios over time, analysts can identify trends and patterns that may indicate areas for improvement.

For example, if the company’s gross profit margin is declining over time, it may be an indication that the company is experiencing rising costs of goods sold. This could be due to a number of factors, such as increasing raw material costs or inefficiencies in the production process.

Case Study

A case study of a company that successfully implemented FIFO is the XYZ Corporation. XYZ Corporation is a manufacturer of consumer products. The company implemented FIFO in 2015 and has since experienced a significant improvement in its financial performance.

Prior to implementing FIFO, XYZ Corporation was experiencing high holding costs and obsolete inventory. By implementing FIFO, the company was able to reduce its inventory levels and improve its cash flow. Additionally, FIFO helped the company to achieve a more accurate cost of goods sold and gross profit margin.

FAQ: Salmone Company Reported The Following Purchases Fifo

What is FIFO?

FIFO (First-In, First-Out) is an inventory valuation method that assumes that the oldest inventory purchased is the first to be sold.

How does FIFO affect inventory valuation?

FIFO results in a higher cost of goods sold and lower ending inventory value during periods of rising prices, compared to other inventory valuation methods such as LIFO.

What are the advantages of using FIFO?

FIFO provides a more accurate representation of current inventory costs and gross profit margin, particularly in periods of inflation.