Fine print w-4 form answer key – Navigating the complexities of tax forms can be daunting, but understanding the fine print of the W-4 form is crucial for ensuring accurate tax withholding. This comprehensive guide delves into the intricate details of the W-4 form, deciphering its nuances and providing practical insights to help you optimize your tax deductions.

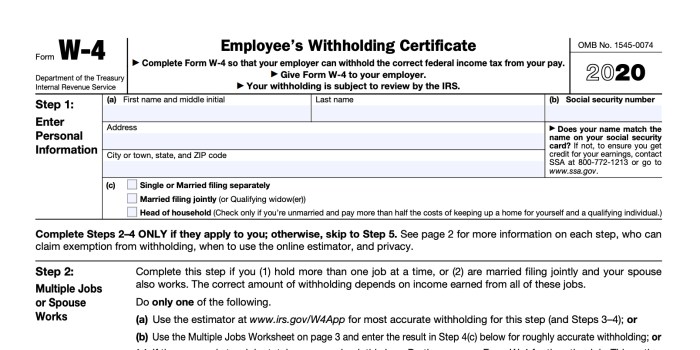

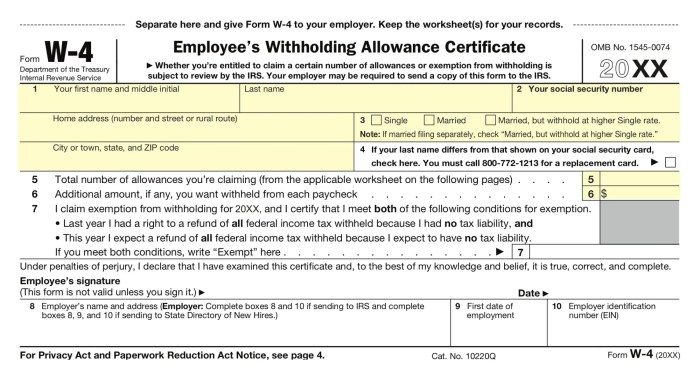

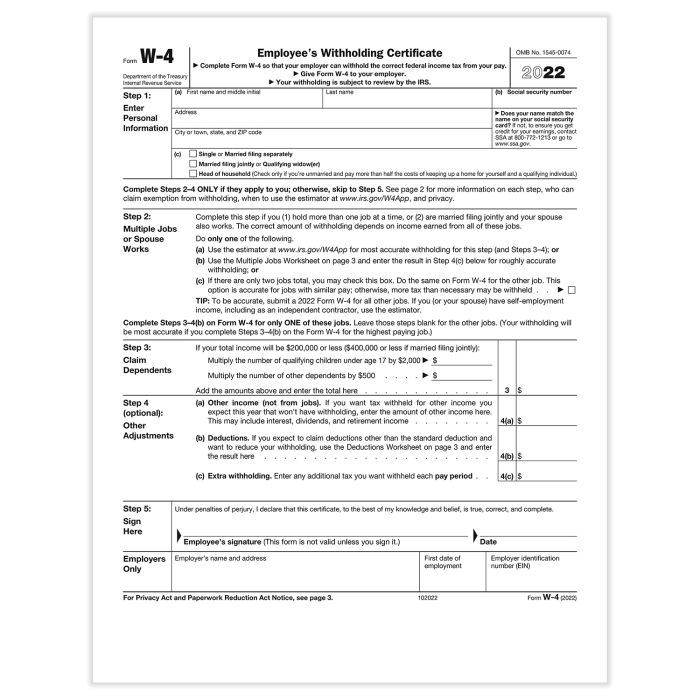

The W-4 form, officially known as the Employee’s Withholding Allowance Certificate, plays a pivotal role in determining the amount of federal income tax withheld from your paycheck. By understanding the fine print, you can ensure that the correct amount of tax is withheld, avoiding potential overpayments or underpayments.

W-4 Form Basics

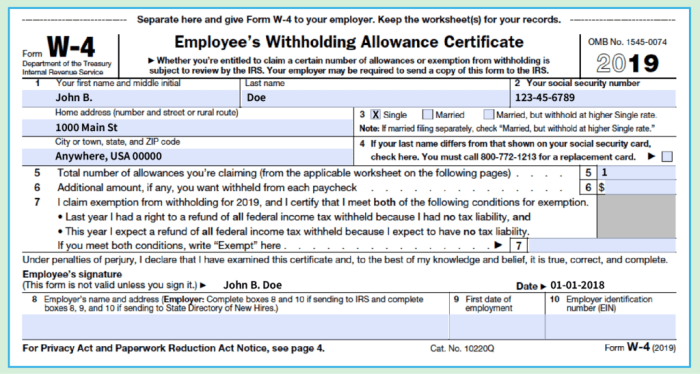

The W-4 form is an essential document used by employees in the United States to inform their employers of their withholding preferences for federal income taxes. It helps determine the amount of taxes withheld from each paycheck, ensuring that employees pay the correct amount of taxes throughout the year.

The W-4 form consists of several sections that collect information about the employee’s personal and financial situation. These sections include:

- Personal information:This section includes the employee’s name, address, and Social Security number.

- Filing status:This section allows the employee to indicate their filing status for the year, such as single, married, or head of household.

- Exemptions:This section allows the employee to claim exemptions, which reduce the amount of taxes withheld from their paycheck. The number of exemptions claimed depends on the employee’s personal circumstances, such as their income and dependents.

- Additional information:This section allows the employee to provide additional information that may affect their withholding, such as estimated itemized deductions or expected tax credits.

Filling out the W-4 form accurately is crucial to ensure that the correct amount of taxes is withheld from the employee’s paycheck. Employees should carefully consider their personal circumstances and consult with a tax professional if necessary to determine the appropriate withholding allowances and exemptions to claim.

Fine Print Analysis

The fine print on the W-4 form contains important information that can impact tax withholding. It’s essential to understand these details to ensure accurate withholding and avoid potential tax penalties.

Significance of the Fine Print

The fine print provides guidance on specific situations and exceptions that may not be covered in the main sections of the form. It clarifies the rules and ensures consistent application of withholding calculations. By neglecting the fine print, taxpayers may overlook important information that could affect their tax liability.

Examples of Fine Print Impact

-

-*Multiple Jobs

If you’re seeking clarity on the fine print of your W-4 form, you might also find it helpful to explore related medical coding information, such as the CPT code for groin exploration . By understanding the nuances of both documents, you’ll be well-equipped to make informed decisions regarding your financial and medical matters.

If an individual holds multiple jobs, the fine print explains how to adjust withholding to avoid over-withholding or under-withholding.

-*Itemized Deductions

The fine print provides instructions for claiming itemized deductions, which can reduce taxable income and lower withholding.

-*Changes in Income or Deductions

The fine print Artikels steps to take when income or deductions change significantly, ensuring timely adjustments to withholding.

Impact on Tax Withholding

The information provided in the fine print of the W-4 form directly influences how much federal income tax is withheld from your paychecks. This withholding is essential as it ensures that you pay taxes throughout the year, avoiding a large tax bill at the end of the year or a penalty for underpayment.The

accuracy and completeness of the information you provide in the fine print are crucial. If your information is inaccurate or incomplete, it can result in either too much or too little tax being withheld. This can lead to complications when filing your annual tax return and potential tax penalties.

Special Considerations: Fine Print W-4 Form Answer Key

The fine print on the W-4 form includes several special considerations and exceptions that taxpayers should be aware of. These exceptions apply to specific situations and can impact the amount of tax withheld from your paycheck.

It’s important to carefully review the fine print and consider if any of these exceptions apply to you. If so, you may need to adjust your withholding to ensure you’re paying the correct amount of tax.

Non-Resident Aliens, Fine print w-4 form answer key

Non-resident aliens, or individuals who are not citizens or permanent residents of the United States, have different withholding rules. They are not eligible to claim certain deductions or credits, which can result in higher withholding.

If you are a non-resident alien, you should refer to the instructions for Form W-4 for Non-Resident Aliens (Form W-4NR) for specific guidance on how to complete the form.

FAQ

What is the purpose of the W-4 form?

The W-4 form is used by employees to provide their employers with information about their withholding allowances, which determines the amount of federal income tax withheld from their paychecks.

What is the significance of the fine print on the W-4 form?

The fine print on the W-4 form contains important instructions and explanations that can impact your tax withholding. It includes information about how to claim allowances, handle special situations, and avoid common errors.

How can I ensure that my W-4 form is accurate?

To ensure accuracy, carefully read and follow the instructions on the W-4 form, including the fine print. Use the IRS withholding estimator tool to determine the appropriate number of allowances to claim based on your income and deductions.